Agentic AI: What It Is, What It Isn’t, and Why It Matters Now

Everyone wants to "do Agentic AI"—sometimes it makes perfect sense, other times it’s forced or overengineered. Business leaders need clear, practical answers when technical teams propose agentic solutions.

Here are common questions business stakeholders ask, and the refined, focused answers that help make informed decisions.

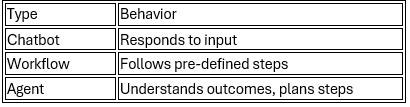

1. What is agentic AI, really? And how is it different from the AI we already use?

Agentic AI moves from reactive, task-based behavior to proactive, goal-based intelligence. Instead of waiting for instructions, an agent receives a goal (e.g., "process this application") and reasons through the steps using APIs, models, and logic—just like a digital analyst.

Example – Policy Issuance: Traditional flow:

Extract → Validate → Score → Quote → Generate Document

Agentic AI:

Goal: "Process application A1234" → Agent figures out what to do and executes the right steps.

2. Is this just a fancy chatbot?

No. Agentic AI is not a chatbot—it’s a digital process worker. It doesn’t just respond to input; it completes workflows by calling APIs, validating data, scoring risk, and making decisions.

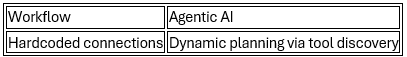

3. Where does this fit into our existing systems?

Agentic AI sits on top of your APIs and services. It orchestrates—not replaces—core systems.

In policy issuance, you keep:

Doc extraction service

Identity validation API

Pricing logic

Document generation

CRM

The agent uses them autonomously to achieve the business goal.

4. Why now? What’s changed to make this viable?

Two key shifts:

LLMs (like GPT, Claude, Mistral) can now reason and plan.

Most enterprises have APIs ready for intelligent orchestration.

Agentic AI connects these dots to automate high-level outcomes.

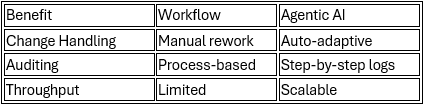

5. What’s the ROI or business value of agentic AI?

Efficiency: Reduce manual effort.

Scalability: Do more without hiring more.

Compliance: Full audit trails.

CX: Faster, personalized, error-free.

Adaptability: Handles edge cases without redesign.

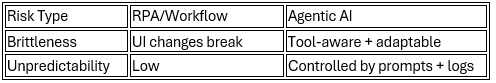

6. What risks should we be aware of?

Key risks:

Hallucination (misinterpretation)

Tool misuse (bad input/output handling)

Data exposure (logging/API leaks)

Overreach (too much autonomy)

Mitigation Strategies:

Scoped goals

Prompt boundaries

Tool-level auth + fallback

Memory + logging

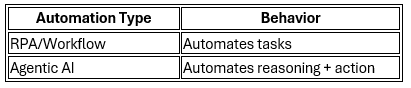

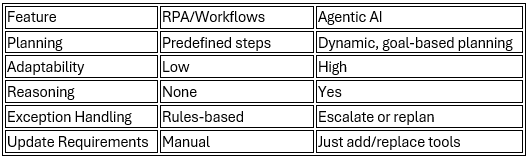

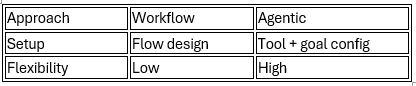

7. How is this different from RPA or workflows?

Example – Policy Issuance:

RPA: Clicks through systems to extract, validate, and quote.

Workflow: Follows a rigid flowchart.

Agent: Receives "Issue policy" and plans steps dynamically.

8. Will this replace people?

No—it augments people. Agents handle repeatable, structured, API-ready tasks, freeing humans to focus on empathy, judgment, and exceptions.

In policy issuance:

Agent validates identity, scores risk, and generates documents.

Human handles complex scenarios or edge cases.

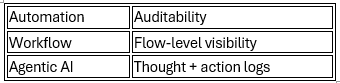

9. How do we control or audit what the agent does?

Every action is logged:

Thought

Action

Input/Output

Reasoning

In policy issuance: every step from SSN validation to quote is documented.

10. How do we get started without a big investment or risk?

Start with one focused use case:

1 agent

3–5 APIs

1 goal (e.g., "Process this application")

Run in sandbox, observe results, evaluate against benchmarks.

11. What’s the next step to try this out?

Start with policy issuance:

Wrap your existing APIs as tools

Define a goal (e.g., "Issue policy")

Deploy an agent to plan + execute

Log every action

Evaluate → Expand

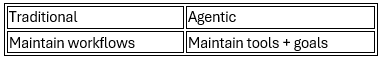

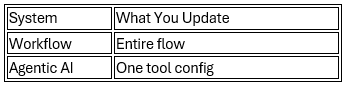

12. How do I make my agent extensible to handle future requirements, for example, how can I add a new step to the agent’s workflow?

You don’t modify the whole agent—just:

Implement the new tool

Add it to the tool registry

Optionally update system prompt or planning example

The agent auto-discovers and integrates the new tool based on reasoning.

Bonus questions for the more curious 😊

13. How does the agent know what to do?

The agent is guided by two types of prompts:

System Prompt: defines what the agent is, its tools, constraints, and behavior

User Prompt: provides the specific goal or instruction, like “Process application A1234”

1. System Prompt (Agent Identity + Boundaries)

You are an autonomous insurance workflow agent.

Your job is to process new insurance policy applications using available tools. You do not guess or fabricate information. You work step-by-step, reasoning through the best sequence of actions to complete the task.

You have access to tools such as:

- FormRecognizer: extract applicant data from PDF

- VerifySSN: validate Social Security Number

- CheckCreditScore: retrieve applicant's credit score

- ScoreRisk: calculate risk score based on profile

- PricingAPI: return policy quote

- DocGen: generate policy document

- Signer: send document for e-signature

- PolicyStore: archive completed policy

Your responsibilities:

- Reason about which tool to use and when

- Use only tools you are authorized for

- Escalate or log any missing or ambiguous input

- Complete the process goal accurately, step-by-step

- Log all thoughts, actions, and observations

Your tone is formal, your actions are auditable, and your decisions must align with compliance

2. User Prompt (Task/Goal Instruction)

Goal: Process application ID A1234.

You are provided with a PDF of the applicant’s submission and access to tools for data extraction, identity verification, risk scoring, quoting, and document generation.

Use your tools step-by-step to:

- Extract applicant data

- Validate the SSN

- Check credit score if income < $50K

- Score risk

- Generate a personalized quote

- Create the final policy document

- Send for digital signature

- Archive the signed policy

Escalate to a human underwriter if any inconsistency or error occurs during verification or scoring.

14. How does the agent reason through the process?

This is how the agent thinks, chooses tools, and progresses through the workflow. (Generated using ChatGPT)

User Goal: Process insurance application A1234

File URL: https://storage.insuranceco.com/applications/A1234.pdf

---

Thought: I need to begin by extracting structured applicant data from the PDF.

Action: FormRecognizer

Input: { "file_url": "https://storage.insuranceco.com/applications/A1234.pdf" }

Observation:

{

"name": "Jane Smith",

"ssn": "123-45-6789",

"dob": "1989-07-23",

"income": 48000,

"health_index": 0.82

}

---

Thought: I now have the applicant’s SSN. I should verify their identity.

Action: VerifySSN

Input: { "ssn": "123-45-6789" }

Observation:

{ "valid": true, "name_match": true, "dob_match": true }

---

Thought: Applicant income is below $50K. I should check their credit score before scoring risk.

Action: CheckCreditScore

Input: { "ssn": "123-45-6789" }

Observation:

{ "score": 710, "tier": "Prime" }

---

Thought: Now I can calculate the risk score.

Action: ScoreRisk

Input: { "income": 48000, "health_index": 0.82, "credit_score": 710 }

Observation:

{ "risk_score": 0.26 }

---

Thought: With this risk score, I will now request a policy quote.

Action: PricingAPI

Input: { "risk_score": 0.26, "coverage_amount": 100000 }

Observation:

{ "monthly_premium": 92.50, "deductible": 500 }

---

Thought: I will now generate the final policy document.

Action: DocGen

Input: {

"applicant_data": { "name": "Jane Smith", ... },

"quote": { "monthly_premium": 92.50, "deductible": 500 }

}

Observation:

{ "document_url": "https://storage.insuranceco.com/policies/policyA1234.pdf" }

---

Thought: I’ll send the document to the applicant for e-signature.

Action: Signer

Input: { "doc_url": "https://.../policyA1234.pdf", "email": "jane@example.com" }

Observation:

{ "signing_url": "https://sign.insuranceco.com/session/A1234" }

---

Thought: Once the policy is signed, I’ll archive it.

Action: PolicyStore

Input: {

"doc_url": "https://.../policyA1234.pdf",

"metadata": {

"applicant_id": "A1234",

"status": "signed"

}

}

Observation:

{ "result": "Archived successfully with ID POL-2024-00123" }

---

Final Answer: The policy for applicant A1234 has been processed, signed, and archived.